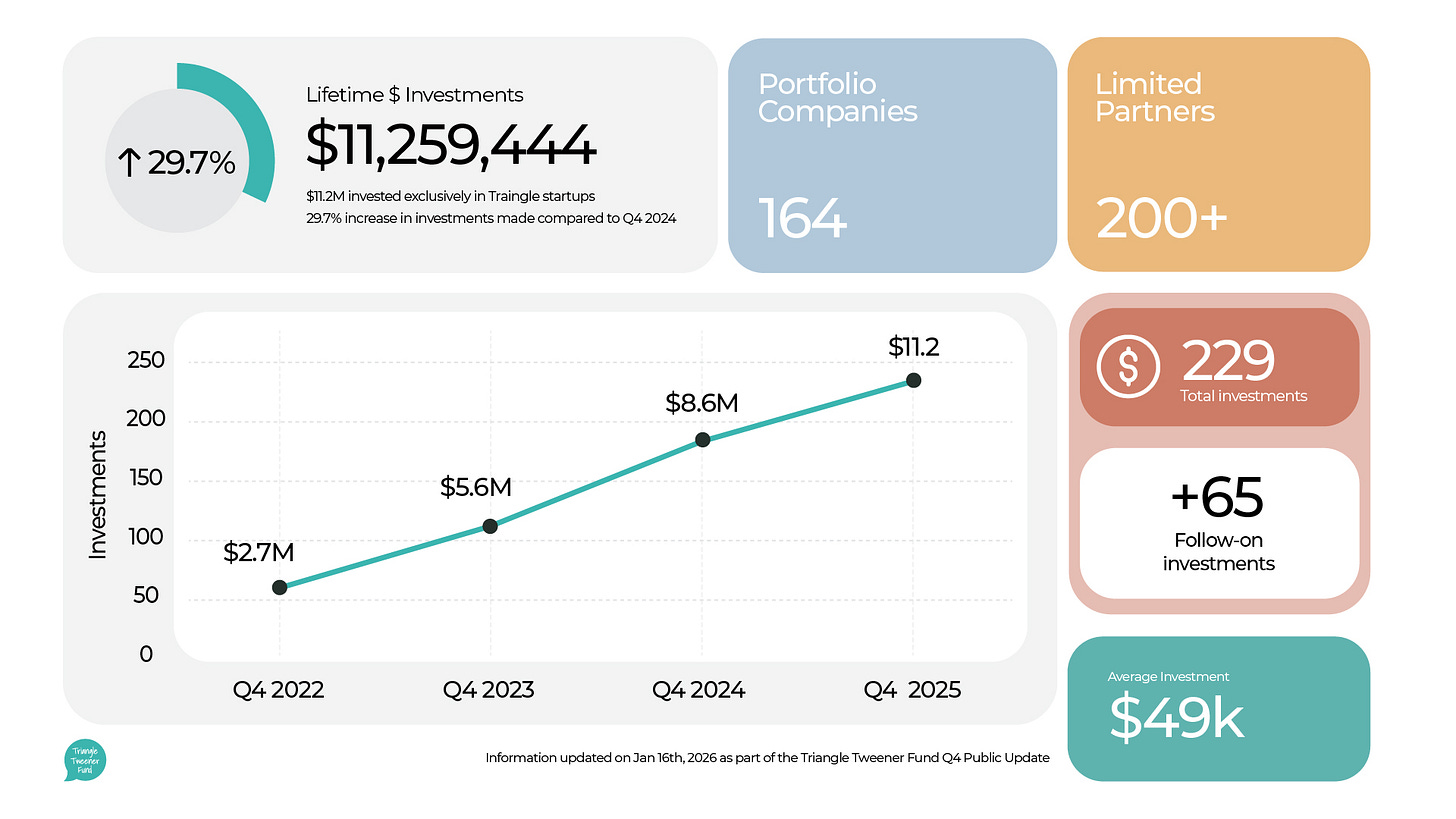

Tweener Fund Update: $575K Invested in Q4 2025, $2.6m Deployed in the year and $11.2m Over 4 Year Life of the Fund 🎉

Q4 Tweener Fund highlights: $575K deployed across 9 deals (2 new, 7 follow-ons), bringing us to $11M+ invested into the Triangle’s startup ecosystem across 164 businesses.

Q4 is typically our quietest quarter because of holidays and everyone’s heads-down. That pattern held again this year, but the quarter still had a clear theme: follow-ons in strong companies and strong up-round signals.

Let’s take a look, but first…

Thank You, LPs 🙌

Before we jump into the recap: thank you to our investors! Whether you’re currently active or have contributed in past quarters. Together, we’ve now invested over $11M into the Triangle startup ecosystem across 164 businesses.

We’re encouraged by where things stand:

Our early-stage “failure rate” is unusually low for early-stage venture firms

We’re seeing strong up-rounds

We’ve already had 12 exits, with many more still on the horizon

Always open for new investors/LPs

Do you want to join with our 200 lifetime Limited Partners (or LPs, what we call our investors in VC) in helping us support Triangle startups? We’re structured as a rolling fund, which means, unlike closed funds that only let investors in every 5-10 years, we are ‘always open’ for new LPs. Here’s the details:

Must be an accredited investor - SEC rule, not ours

1yr commitment, $30,000 for the year or $7,500/Q

1% management fee, 20% carry and a small AngelList administrative fee

For more details - visit www.tweenerfund.com where you can see our pitch and hit the invest button to get started - we’d love to help you and you can come on the journey for the next $10m!

We couldn’t share posts like this without our amazing sponsors:

Featured Gold Sponsor

Featured Silver Sponsor

2025 Sponsors

ExtensisHR - As a Professional Employer Organization (PEO), ExtensisHR empowers tech founders and growing businesses to scale smarter. We take HR administration off your plate—managing payroll, recruiting, employee benefits and retirement plans, compliance, risk, and more—so you can focus on innovation. For over 25 years we’ve leveraged a people-first approach, customer-centric mindset, and deep industry expertise to ensure employers have the tools needed to stay competitive in today’s market.

Q4 Investing Highlights

Historically, Q4 is our slowest quarter, and that was true again this year.

Our Tweener Fund Q4 2025 Snapshot:

$575K invested across 9 deals (2 new, whopping 7 follow-ons)

New Portfolio Companies

Alubri: Transforming women’s care

CivicReach: Helping government & social service agencies improve service

Also, Tweener Fund made additional investments in 7 portfolio companies:

Alcove Rooms: Platform for managing and listing room rentals

Galaxy Diagnostics: Stealth pathogen testing (Bartonella, Babesia, Borrelia)

Opine: Platform for managing proof-of-concepts in the sales process

Voxel Innovations: High-quality metal components using pulsed electrochemical machining (PECM)

Roboro : Custom legislative insights at your fingertips via AI.

Blue Co: Warehouse coworking

Phinite: Turns animal waste into sterilized fertilizer

Q4 Events: Tweener Fund at Topgolf

At Tweener fund, we invite our ~200 founders and ~300 LPs to quarterly events. our Q4 event was a more chill ‘hangout’ → Triangle Tweener Night at Raleigh Founded.

The format was designed for meaningful founder-level conversation, not networking-for-networking’s-sake:

A resource fair connecting portfolio founders with sponsors/partners

Multi-track discussions including:

Building & Scaling Tech (stack, efficiency, trends)

Product-Market Fit + Hiring + Avoiding Burnout

IP Protection + Positioning

A larger interactive discussion on:

Leveraging AI in startups

Making higher-signal connections

Funding environment challenges and collaborative improvement

There were a TON of good ideas that we are sorting through and implementing, and we’ll keep experimenting with formats like this

Expect more creative formats like this in 2026. We love testing new ways to bring the Tweener community together.

Become a Sponsor

Would your company benefit from exposure to the Triangle’s fastest-growing startups?

Our audience is made up of Triangle founders and operators, primarily at startups doing over $1M/year and many much larger. When a company hits Tweener status, they’ve got real traction, funding (usually), a growing team, and momentum.

Thanks to strong demand, we’re upgrading our sponsorship opportunities across Tweener Times, Tweener Talks, and more.

If you’re looking to connect with this high-impact community, now’s the time. Send us a message or an email to contact@tweenerfund.com.

Let’s build together!

Other Q4 Events

Beyond investing, Q4 also included several opportunities for our team to show up across the Triangle startup ecosystem, sharing perspective, listening to founders, and staying close to what’s happening on the ground.

NC IDEA “Where Are They Now?” - Robbie was on this, check it out.

Inside NC/NC IDEA podcast appearances - We had “back-to-back” appearances, & Scot was on a “Top Startups to Watch” segment, check it out.

NC IDEA “Top Startups to Watch” - Tweener took 5/5 RTP companies this year!

Bank of America Summit panel - Scot led a panel and the team got some valuable insights. We summarized it here!

First Fridays at Raleigh Founded - Shuping and Becca were there, met a lot of founders, and want to hear more pitches at the next one!

NC IDEA Ecosystem Summit - Scot sat on a panel for NC IDEA’s 2025 Ecosystem Summit.

2025 Recap

2025 was a strong year:

49 investments

$2.6M invested

$53.6K average check-size

We also saw continued movement in deal mechanics:

SAFE’s continue to dominate

Convertible notes keep declining (often reserved for later-stage bridge scenarios)

Priced rounds are growing fast, an early sign of investors getting more comfortable setting valuations again

2025 concluded our fourth year of operations. That gives us a life of the fund with:

228 investments

164 companies

$11.2M invested

$49K average investment

🙌 Thank You

Thank you to everyone who continues to show up for the Tweener community. We have some big plans for Q1 - stay tuned for more information, the best way to stay informed is to subscribe to the Tweener Times 👀👇